Euro crashes to four month lows ahead of Powell testimony

- Go back to blog home

- Latest

The common currency was sent tumbling to its weakest position in four months against the US dollar on Tuesday morning, as investors continued to digest some contrasting economic data releases across the Atlantic.

Meanwhile, the latest data readings out of the US economy have been pretty impressive, particularly last Friday’s nonfarm payrolls report that showed a move higher in job creation and acceleration in earnings growth. Federal Reserve Chair Jerome Powell is likely to highlight the recent solid data during his highly anticipated two-day testimony to Congress this afternoon. As we noted yesterday, we think that Powell will continue to strike an upbeat tone, although there is a risk that he sounds a more-dovish-than-expected note on the coronavirus outbreak, which could weigh and the dollar and provide some much needed support for EUR/USD.

Powell is set to speak at around 15:00 UK time (16:00 CET).

Markets continue rebound on easing virus concerns

Ongoing concerns regarding the coronavirus outbreak are not really helping the euro’s cause, given the Euro Area’s greater dependence on external demand than the relatively isolated US economy.

We do, however, note that financial markets have remained remarkably stable, with many of the flows in the FX market induced by the virus now retracing. Emerging market currencies and equity markets have rebounded. The S&P 500 and Dow Jones indexes are now back trading higher year-to-date, while the Shanghai Composite index has at least stabilised following its sell-off.

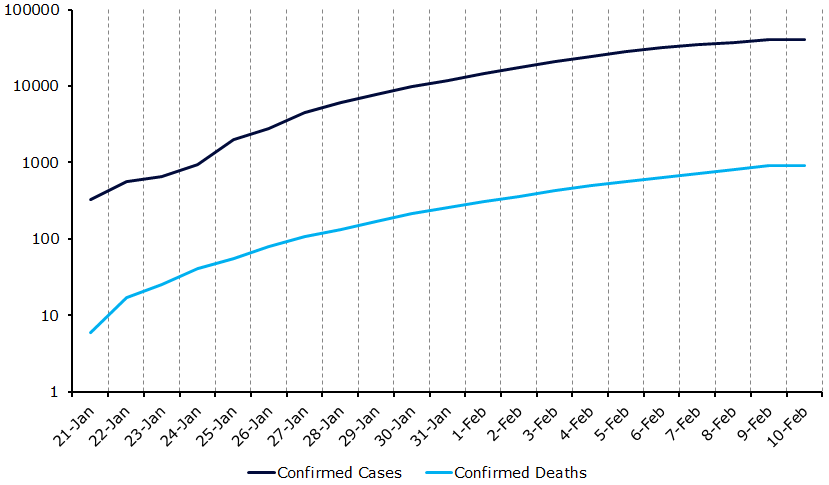

Investors have been calmed somewhat by the fact that the virus has so far remained mostly contained within China. Creating a logarithmic chart of both the number of confirmed coronavirus cases and deaths caused by the virus (Figure 1), which removes the exponential nature of the early spreading, we can see that the rate of transmission also appears to be easing. This is a very encouraging sign that hopefully suggests both the financial market and economic impact of the virus will be slightly less severe than many had feared at the virus’ outbreak.

Figure 1: Coronavirus Confirmed Cases & Deaths [log scale] (21/01/20 – 10/02/20)

Pound edges off lows on December growth pick-up

Sterling edged higher this morning, rallying off near its lowest level in two-and-a-half months versus the greenback, following a slightly better-than-expected set of GDP growth figures.

The UK economy failed to grow at all quarter-on-quarter in the final three months of 2019, as expected, although the December numbers showed that the economy at least ended the year on a decent footing. Growth picked up to 0.3% month-on-month, up from the 0.2% that investors had priced in. This has provided investors with some optimism that the outcome of December’s election, and the subsequent removal of the short-term ‘no deal’ uncertainty, will be reflected in a sustained pick-up in UK growth in 2020.

The rest of the week is very light in terms of UK data, so attention will likely be on events elsewhere, namely Powell’s testimony and coronavirus headlines.