How is sterling trading one week ahead of the election?

- Go back to blog home

- Latest

Supreme confidence among investors that the Conservative Party are highly likely to secure a comfortable majority victory at next Thursday’s election continues to support the pound.

With a Tory majority now heavily priced in, any outcome other than that would be a significant disappointment for the market and would likely lead to a sell-off in the pound. We have mentioned in the past few weeks that a Labour government could lead to a higher GBP in the long-term, should the party follow through with their pledge to hold a second referendum. The reaction in the immediate aftermath would, however, now likely be a sell-off as investors focus initially on the uncertain policy changes that a Labour government would bring, namely tax hikes and massive spending increases.

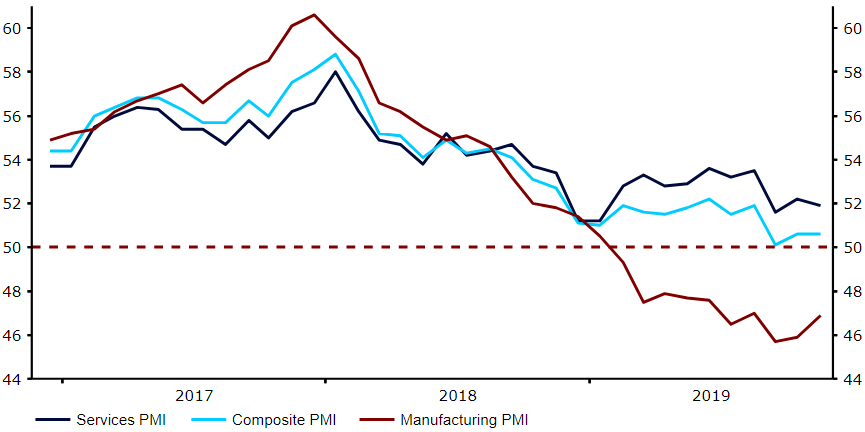

An improvement in the November services PMI also didn’t harm sterling’s cause on Wednesday. The index remains in contractionary territory, although rose to an above forecast 49.3, which is an encouraging sign.

Figure 1: UK PMIs (2016 – 2019)

President Trump talks up US-China trade progress

EUR/USD had a short-lived burst above the 1.11 mark yesterday, before retreating back below it just as quickly.

The market continues to be bombarded with contrasting news out of the US-China trade discussions, with investors at this stage totally unsure as to what headlines to believe. During his three-day trip to the UK, President Trump stated that negotiations with China over trade were going ‘very well’. This comes off the back of news earlier in the week that the US was pushing ahead with its plans to impose tariffs on Chinese imports on 15th December.

Yet, with still no real concrete news on this front, investors are holding back from committing to significant bets in either direction. The common currency has this morning subsequently returned back to the narrow range that it held on Tuesday.

Soft ADP number bodes ill for payrolls report

Amid the trade headlines, we have also had a slew of macroeconomic data out of both the US and the Eurozone in the past 24 hours or so.

As we mentioned yesterday, Wednesday morning’s Euro Area business activity PMIs showed encouraging signs of a move higher, despite remaining at relatively lowly levels. News out of the US economy was, however, contrastingly poor. The latest ADP employment change number, showing job creation in the US private sector, was much worse than economists had predicted, falling to just 67,000 from a downwardly revised 121k. Not only was this the lowest level in the measure in six-months, it also bodes poorly for tomorrow’s nonfarm payrolls report. The ISM non-manufacturing PMI also missed its mark, slipping back to 53.9 in November.

Next up will be tomorrow’s all-important nonfarm payrolls report. While Wednesday’s aforementioned data releases didn’t have too much of an impact on the dollar, a downside surprise to tomorrow’s payrolls number would, we believe, very likely lead to at least some sort of sell-off in the greenback.