US dollar rallies as coronavirus fears abate

- Go back to blog home

- Latest

Signs that the rate of spread of the coronavirus was slowing down in China fuelled a general rally in risk assets worldwide last week.

This week the focus shall remain on the daily releases of coronavirus contagion figures in China and worldwide, the more so because data will be light. Fed Chairman Jerome Powell’s semi-annual testimony before the US Congress on Tuesday will also be important.

UK fourth-quarter GDP growth on Tuesday, Eurozone industrial production data on Wednesday and US inflation Thursday will be the main data highlights. The New Hampshire Democratic primary on Tuesday could also provide some fireworks if it confirms that the left-wing of the party represented by Bernie Sanders is now ascendant.

GBP

Last week saw substantial upward revisions to the January PMIs of business activity, which bodes well for growth in 2020. That didn’t help cable, which fell in line with the general dollar rally and Boris Johnson’s continued hard-line stance towards the UK’s EU negotiations.

Expectations for this week’s GDP numbers are low, with the median economist expecting a flat reading. This is a backwards-looking number that will be affected by the uncertainty over Brexit, which did not dissipate until the general election late in the quarter. However, the bar for an upward surprise looks lower than usual and sterling is looking oversold, particularly against the US dollar.

EUR

The euro has been broadly weaker against the dollar in the past couple of weeks, although it has found a bit of support around the key 1.10 level. Recent weakness in the currency can, in part, be attributed to coronavirus concerns, an issue for the Eurozone given the bloc’s dependence on export revenue for around 40% of its overall GDP.

This week should be a quiet one in the Eurozone. The only data of note to be released will be industrial production for December, too backwards-looking to have a meaningful market impact. While several ECB speakers are on tap, it is unlikely that they will share material information on the state of policy discussions in the central bank. For now, euro moves will depend on news elsewhere.

USD

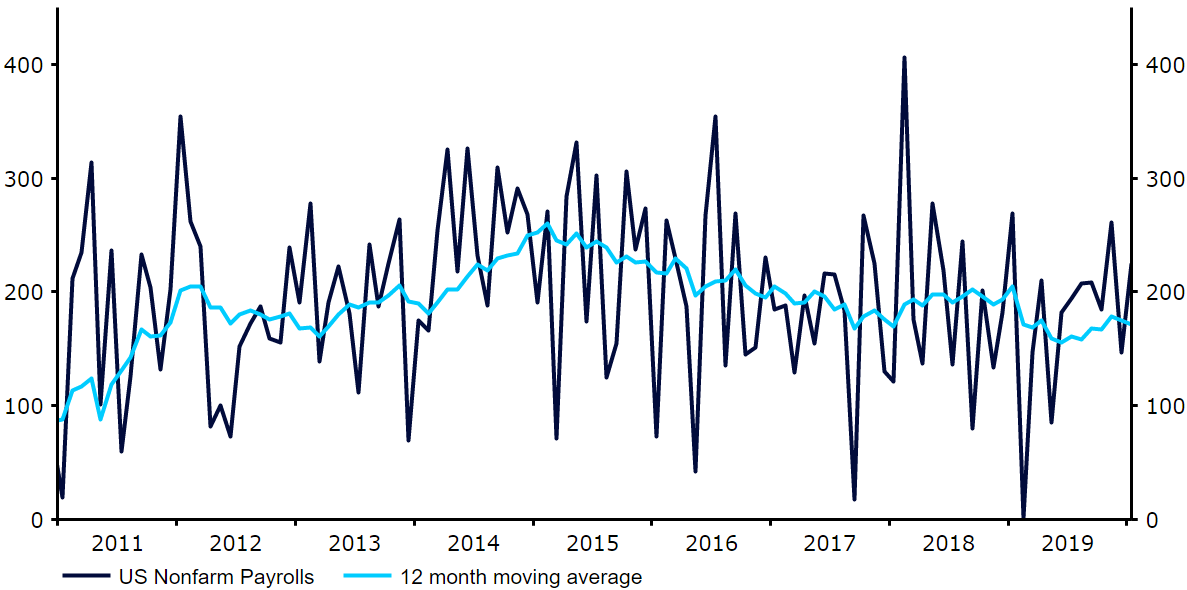

Fed Chair Jerome Powell’s testimony in front of Congress should reiterate the Fed’s modestly optimistic message that the US economy is currently doing well without inflationary pressures, and that the central bank remains on hold for the foreseeable future. The recent performance of the US labour market should be a source of optimism for Powell, with last week’s nonfarm payrolls report showing a strong bounce in job creation (Figure 1) and move higher in wage growth.

Figure 1: US Nonfarm Payrolls (2011 – 2020)

CPI inflation on Thursday should confirm that it remains roughly in line with the Fed’s target and that no tightening is needed for now. In terms of the impact on currency markets, the recent US rally against the euro looks stretched and we think that there is room for the common currency to rally back towards the top of its recent range, near 1.1150 over the next few weeks.